Sales Tax Audit Defense

A proactive approach with a trusted name in sales & use tax consultancy can remove the headache of being under audit, and save you considerable time and resources. Upon engagement, TaxMatrix will defend you and your business against sales tax audits, ensuring that proper audit methodology is employed to reduce the assessment while identifying and securing refunds along the way.

Our 5-Point Value Proposition for Sales Tax Audits Include:

- Engage the audit during any part of the process: Upon notification, audit in progress, or post-assessment.

- Audit representation, sampling methodology, facility walk-through and/or pulling documentation.

- Review the audit period to decrease the assessment and identify credits or overpaid/over-accrued sales and use tax used to offset the assessment.

- Provide a free Custom Tax Workshop to share our findings, so the client can mitigate future overpayments and keep those dollars in-house.

- Avail of our free Tax Help Desk for one year per state reviewed to answer ad hoc sales and use tax questions.

Connect With Our Experts Today

Our Sales Tax Audit Defense Representation

For over 20 years, TaxMatrix has assisted clients with multi-state sales and use tax audits across all industries. Our sales tax audit defense practice is managed by our Client Engagement Team comprised of tax managers and former state auditors well-versed in audit procedures. Our expert team always ensures your final assessment is fair and that any refunds are identified and credited accordingly.

TaxMatrix can manage the audit process from start to finish or can simply serve as a final set of eyes. Our audit team will gather the files necessary to build the case and determine which issues are ideal for appeal. We can manage the information flow between the client and the state taxing agency to ensure complete and accurate responses, while assisting with accelerated dispute resolution processes to reduce costs.

Understanding the Sales & Use Tax Audit Defense Procedures

A sales tax audit typically covers 3 to 4 years of your business activity (depending on the state) from when a return was filed, and even farther back if sales and use tax returns have not been filed. The slightest error in a type of transaction can increase sales tax liabilities, and oftentimes, a sales tax audit can be driven purely by simply not having the correct paperwork.

A sales tax audit begins with a notice from the Department of Revenue. It is important to have all your paperwork in order and/or begin filling in the gaps prior to the audit starting. Know that the paperwork you are turning in will serve as an example of how your business handles specific types of transactions. If the sample transaction was processed incorrectly, the system will assume all such transactions violated tax law. This is the reason fines rise so quickly and why you need a professional at your side to manage the fallout. There are ways of proving the sample was an isolated incident. There are also ways of pre-assessing your paperwork to detect – and correct – these issues before they’re submitted.

Examples of the records you may need include:

- Fixed-asset purchases

- Non-asset expense purchases

- Sale and use tax returns

- Exemption certificates

After an initial meeting to discuss your business, the field auditor will perform an examination by comparing the taxpayer’s books and records to the items reported on the sales tax return(s). The Department will then issue a report with adjustments where a preliminary assessment will ultimately become a final assessment. The process can take months or years, and with penalties and interest mounting, taxpayers need a strategy to contend with the audit, minimize the final assessment and hopefully add credits to offset the amount due. The state is only interested in tax that should have been paid/accrued – not what was overpaid. At any step during the audit process, the taxpayer may engage a consultant to assist and work with the auditor.

You can greatly lower your chances of a sales tax audit, though some businesses are on a set schedule and others are chosen at random. Below are some common reasons why companies come under audit:

- New business activity: new construction, new expansion, new location(s).

- Past audit history: If your last audit ended in assessment, you will be on the state’s radar.

- The volume of sales and exempt sales a company reports to the state.

- Ratio and/or change of the ratio of exempt sales to total sales.

How Does TaxMatrix Help with Sales Tax Audits?

Our sales tax audit defense services include:

- Audit representation

- Audit coordination

- Audit sampling analysis and evaluation

- Taxability determinations

- 2nd and final review (as a best practice)

- Audit appeals

We meet directly with auditors, dispute resolution officers, administrative hearing attorneys, and other agents to clearly identify all positions that impact our Client’s ability to achieve a favorable outcome. We represent our clients’ interests to ensure they pay only their fair share of taxes.

Get Comprehensive Audit Services

In addition, every client gains no-fee access to our Tax Help DeskSM for ongoing compliance support, saving you time and money when you need it most. (help@taxmatrix.com)

Our team looks forward to partnering with you to support your company’s compliance and recovery objectives. If you are interested in learning about our sales tax audit defense service, please contact us today.

Sales Tax Audit Defense FAQs

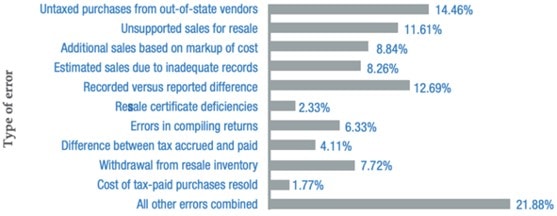

What are the top 10 errors found in audits?

- Untaxed purchases from out-of-state-vendors

- Unsupported sales for resale

- Additional sales based on markup of cost

- Estimated sales due to inadequate records

- Recorded versus reported difference

- Resale certificate deficiencies

- Errors in compiling returns

- Difference between tax accrued and paid

- Withdrawal from sale inventory

- Cost of tax-paid purchases resold

- All other errors combined

Why is my audit taking so long?

Once the State sends a formal notice, the proverbial clock has stopped and the State can prolong the process as needed, given personnel changes/shortages, other audits, etc. Interest and penalty continue to accrue, and with waivers, the audit period can be extended past the 3-4 year statutory period by State.

Why engage an outside consultant for my audit?

Many taxpayers elect to work an audit assessment down to the point where they feel nothing more can be done, or in some cases, where the reserve has been met. While TaxMatrix can work an audit from the beginning, most of our clients contract with us for an “audit triage” situation by which we can review the current assessment and/or work to identify credits to offset the assessment. By having a fresh set of eyes on the audit, perhaps we can find a way to substantiate a new position or identify credits for previously unused tax-exempt items. We can also evaluate the auditor’s sampling methodology. Thus, if an auditor identifies errors that only took place in the first year of an audit, and chooses to extrapolate those errors to other years, the taxpayer has an inflated assessment.

TaxMatrix can also assist with auditor coordination, plant walk-throughs, waivers and interest/penalty reduction to maximize the benefit to the taxpayer while the audit period is open.

How is TaxMatrix compensated?

We use a flexible fee structure since not only engagements are the same. When working an audit from the very beginning, we might incorporate an hourly fee structure or carve out credits on a success basis. If the Client merely wants a second set of eyes, in many cases a straight success fee is warranted as the Client does not want to come out of pocket unless our service produces monetary results. In that case, our only billable event is derived from dollars removed from the assessment and/or dollars credited against the assessment.

We just paid our audit, so what can TaxMatrix do to help?

States expect taxpayers to file credits (refunds), but do not want anything to impede receiving payment for the assessment. As such, states allot taxpayers time to file for redetermination and/or file credits, but every state is different. In Pennsylvania, taxpayers may file a petition for reassessment within 90 days of the mailing date for the assessment. Refunds for taxes paid with respect to the audit period can be filed within 6 months of the mailing date. In New York, taxpayers have 2 years to file for refunds, but only up to the tax paid in the assessment. TaxMatrix can be engaged at any time during the audit process, and can still add value to post-paid assessments depending on the state.

Additional Sales & Use Tax Services

Are you in need of additional sales tax services from a trusted and reliable tax consultant agency? View our Sales Tax Recovery and Utility Exemption services now!