Custom Sales and Use Tax Matrix

Over 700 million custom tax determinations to date (and counting)…

Companies operating in a multi-state environment find it increasingly difficult to stay compliant in respect to sales and use tax determinations. States operating in budget deficits continue to change exemptions while accounts payable and vendor turnover create a natural error rate. The challenges are endless. How does a state define “nexus” and where do you have it? Who is the end consumer? How does each state treat cloud computing? How does the use of the good / service affect the taxability matrix? On both the purchase and sales side of a transaction, companies need a true road map to compliance built on how “they” operate their business. That road map is a Custom Sales and Use Tax Matrix.

Launched in 1999, TaxMatrix is the leader in providing streamlined customized Sales and Use Tax Matrix solutions for any industry, along with complimentary audit support should a tax determination come under scrutiny. Our history began in the retail sector where we created the world’s largest and most granular tax matrix, the UPC MatrixMaster, which manages product taxability down to the SKU level. The patented solution attracted the attention of retilers nationwide, where we eventually managed the compliance of over $300 billion of transactions annually. State agencies adopted the solution as the database evolved, setting a standard for defining product taxability in the complex grocery, convenience and specialty retail space.

What is a Custom Sales and Use Tax Matrix?

A Custom Sales and Use Tax Matrix effectively maps the correct tax determination by way of goods or services sold or purchased across your footprint. Category-based online tools are sufficient for basic rules, but not exceptions. A customized solution is the only way to ensure tax compliance because that margin of error can lead to significant exposure under audit. Companies do not need a solution to only get them halfway there; they need a road map where every element of the tax accounting process can remain in sync to mitigate the natural error rate. Below is a chart showcasing the differences between an Online Research Library, a General Tax Matrix and a Custom Tax Matrix:

|

Online |

General |

Custom Tax Matrix |

|

|---|---|---|---|

|

Granularity |

Category-based; Ignores Use of good/service State Level Only |

Category-based; Ignores Use of good/service; State Level Only |

Built specific to Client Needs; Accounts for use of good/service; Including Local Level |

|

Best When Used By |

Small service-based companies with less complexity |

Small service-based companies with less complexity |

Any type of company regardless of complexity, taking into account any facet that might affect taxability |

|

Visual |

Graphical Representation can include product data |

Point-and-click matrices may be easy to build, but ultimately not user friendly and do not take into account all factors |

Matrices are carefully researched, rewritten in common language with footnotes, and includes all exceptions that may be applicable |

|

Training |

No training |

No training |

Free Custom Tax Workshop to cover the entire matrix, and also answer any questions that may not be covered in the matrix |

|

Audit Support |

None |

None |

Free audit support for any determination under auditor scrutiny |

|

Compliance Support |

No complimentary support |

No complimentary support |

All clients of TaxMatrix enjoy permanent access to our Tax Help Desk for any sales/use tax compliance question in any taxing jurisdiction |

Are you part of a CPA practice? Learn about CPA Start to guide your clients!

Examples of TaxMatrix Custom Tax Matrices:

- Multi-State Retailer: 6 states/jurisdictions and 4,421 products/services. Use Tax Matrix covering items purchased for use, consumption and sale in their stores.

- Multi-State Rental Company: 51 states/jurisdictions and 44 products/services. Sales Tax Matrix providing guidance on products and services sold to customers.

- Multi-State Service Company: 535 locations across 31 states. Sales Tax Matrix providing assistance on the appropriate liquor license rules for each location.

- Multi-State Construction Company: 7 states/30 products/services. Sales Tax Matrix covering rental items under various conditions to sub-contractors.

- Multi-State Retailer: 13 states/jurisdictions and 20 products/services. Use Tax Matrix covering products/services purchased as to whether they needed to pay sales tax or accrue use tax on the items.

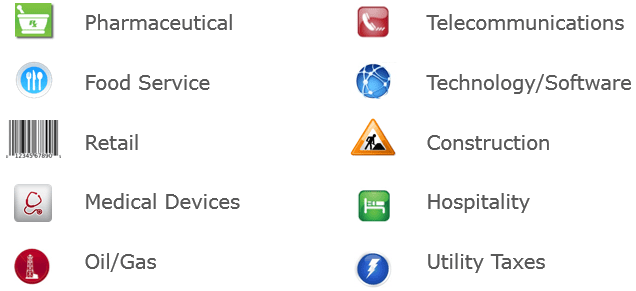

Common Industries that Benefit from Custom Sales Tax Matrices

With tax departments in other industries struggling with limitations inherent to tax research and look-up services, tax teams began to contact us for stand-alone solutions to fit their specific compliance needs. A true tax determination cannot simply be generated by an online look-up tool or intelligent chart; it requires a strong research acumen to take into account every facet of that transaction.

The foundation of our Custom Tax Matrix service relies on our research team that strictly focuses on tracking, monitoring and managing changes in sales and use tax laws/codes. Software and bolt-on applications cannot replace our team’s day-to-day research and connection to various state agencies to provide a best-in-class service. Tax teams need granularity – not generality – to optimize the tax determination process.

How do I get started?

If you believe a Custom Sales and Use Tax Matrix is the right solution for you, below are the simple steps to take on your road to tax compliance:

- Scoping Session determines parameters of Custom Tax Matrix, clarifying the transaction types by category and number of jurisdictions involved

- TaxMatrix scrutinizes each transaction/jurisdiction combination by:

- Conferring with state agencies (anonymous on behalf of client)

- Examining applicable letter rulings and court cases

- Utilizing government websites, CCH Intelliconnect, and RIA Checkpoint

- Researching vendors and, if needed, client follow-up for clarification on use

- TaxMatrix returns Comprehensive Custom Tax Matrix to client and training call is scheduled to answer any questions

- TaxMatrix defends any determination inside of an audit at NO COST

- Client gains permanent access to Tax Help Desk for ongoing compliance support

View a printable presentation or contact a Custom Tax Matrix specialist today!